DEGEN Token Explained: The Meme Coin for Crypto Risk Takers

Key Takeaways

• DEGEN is a meme coin that incentivizes social participation and experimentation in onchain culture.

• It is primarily used for social tipping, micro-incentives, and community engagement.

• Users should be aware of extreme volatility, liquidity risks, and the importance of verifying contracts.

• Safe practices include using reputable networks, decentralized exchanges, and maintaining self-custody.

If you spend time on crypto social apps, you’ve likely seen tips, bounties, and in-jokes paid out in DEGEN. Born from the Farcaster community and supercharged by the Base network’s low fees, DEGEN has become a cultural and speculative phenomenon—part tipping currency, part social incentive, part pure meme coin. This guide breaks down what DEGEN is, how it works, the risks to understand, and how to interact with it safely.

What is DEGEN?

DEGEN is a community-driven meme coin that emerged from Farcaster, a decentralized social protocol where developers and creators build social apps, “Frames,” and channels. The token gained traction through social tipping—rewarding posts, tools, and community contributions—and later expanded into broader onchain usage.

- Farcaster is a permissionless social protocol designed for composability and user portability. Learn more about the stack and how Frames power onchain interactions in feeds in the official Farcaster docs (see Frames section at the end of the page): Farcaster documentation.

- Base is an Ethereum Layer 2 built on the OP Stack with low fees and fast finality, which helped DEGEN’s activity scale. Explore the network and builder resources at Base and see Base’s security and TVL profile at L2Beat.

Put simply: DEGEN is a social-native token that incentivizes participation and experimentation in onchain culture—embraced by users who self-identify as “risk takers.”

How DEGEN is used today

- Social tipping and rewards: DEGEN became a default tipping currency across Farcaster apps and channels, with Frames enabling seamless one-click interactions inside posts. Frames are explained in the Farcaster docs (see Frames on the same page): Farcaster documentation.

- Onchain micro-incentives: Communities use DEGEN to bootstrap engagement for hackathons, mini-grants, content bounties, and discovery games.

- Ecosystem experiments: As Base matured, DEGEN integrated with bots, leaderboards, and community tools that track tips and activity. The low-fee environment on Base is central to these microtransactions: Base.

Some seasons of DEGEN distribution have historically rewarded active community members, but the mechanics and allocations can change. Always verify any live campaign details from primary community channels before participating.

Degen Chain and L3 narratives, briefly

Beyond Base, community experiments have spotlighted app-specific L3s—application-focused chains that settle to L2s while offering custom economics, potentially including DEGEN as a gas token. While L3s are still an evolving design space, the general idea is to specialize throughput and UX for a specific app or community. For background on the stack and orbit-style L3s, see Arbitrum Orbit. Infrastructure choices, security assumptions, and upgrade permissions vary—do your homework before bridging or using unfamiliar L3s.

Why DEGEN resonates with risk takers

- Cultural velocity: Meme coins live and die by attention. DEGEN’s tight feedback loop between social content and tokenized rewards keeps the narrative moving quickly.

- Composability: Farcaster’s open protocol and Base’s low fees encourage rapid iteration—Frames, bots, leaderboards, and games can ship fast.

- Speculative upside—and downside: The same features that drive engagement can amplify volatility. DEGEN is high risk and may be extremely volatile over short periods.

For a primer on meme coins and their dynamics, see CoinGecko’s explainer: What Are Memecoins?

Key risks to understand

- Extreme volatility and liquidity risk: Meme coins can move sharply. Flash rallies often retrace.

- Smart contract and approval risk: Only interact with verified contracts and trustworthy apps. Periodically review and revoke token approvals using tools like Revoke.cash.

- Bridge and L2/L3 risks: Moving assets between chains and rollups introduces additional trust assumptions and technical risk. Use official bridges and review documentation (for Base, start at Base).

- Social engineering and phishing: Frames and bots are powerful but can be abused. Verify domains, double-check what permissions you sign, and simulate transactions when possible.

- Regulatory and tax uncertainty: Rules vary by jurisdiction. The U.S. CFTC’s advisory outlines general crypto risks for consumers: CFTC Customer Advisory

None of the above is investment advice. Treat DEGEN as speculative and size positions accordingly.

How to get DEGEN and use it safely

- Choose a network: DEGEN activity centers on Base. Confirm the correct network and token details in reputable explorers and community docs. You can browse the Base explorer at BaseScan.

- Acquire tokens:

- Decentralized exchanges on Base: Research liquidity and routing using established DEXs like Uniswap, and verify the token contract in the DEX UI and on BaseScan before swapping.

- Centralized venues: Listings may vary and can change; follow official project communications for updates and beware of impostors.

- Store and transact securely:

- Use a wallet that supports Base and EVM assets, shows clear transaction details, and lets you verify addresses on a secure screen.

- Regularly review allowances and unknown app connections with Revoke.cash.

- Interact via Farcaster and Frames:

- If you tip or claim via Frames, read the permission prompts and avoid granting unlimited approvals. Reference the Frame architecture in the Farcaster docs (see Frames): Farcaster documentation.

Token mechanics and supply notes

DEGEN’s supply, distribution seasons, and community incentives have historically been shaped by the grassroots Farcaster community rather than a traditional top-down token launch. That can make the token feel “alive” but also harder to model.

- Expect changes: Season-based rewards, community proposals, and app integrations can shift allocations and incentive weights.

- Verify from source: Always check official project channels for current rules and any claims about supply, utility, or new integrations.

What to watch next

- Social x onchain UX: Frames and embedded transactions are making consumer crypto feel “app-like.” Expect more micro-incentive designs and experiments that could benefit social tokens like DEGEN. See how Frames work conceptually in the Farcaster documentation.

- L2/L3 specialization: As Base continues to grow—track its security model and TVL at L2Beat—expect more app-specific chains and gas token experiments around social and gaming.

- Better safety rails: Transaction simulation, permission scoping, and allowance management will be key for consumer adoption. Users should demand clear, human-readable signing.

Pro tips for DEGEN power users

- Prefer official links and verified contracts surfaced by explorers like BaseScan.

- Simulate risky swaps and approvals when your wallet supports it.

- Use multi-accounts: keep a “hot” spending account separate from long-term storage.

- Time-bound approvals: Grant minimum allowances and revoke regularly via Revoke.cash.

- Bridge prudently: If you must bridge, favor official bridges and small test amounts first. Start at Base for canonical resources.

A note on self-custody

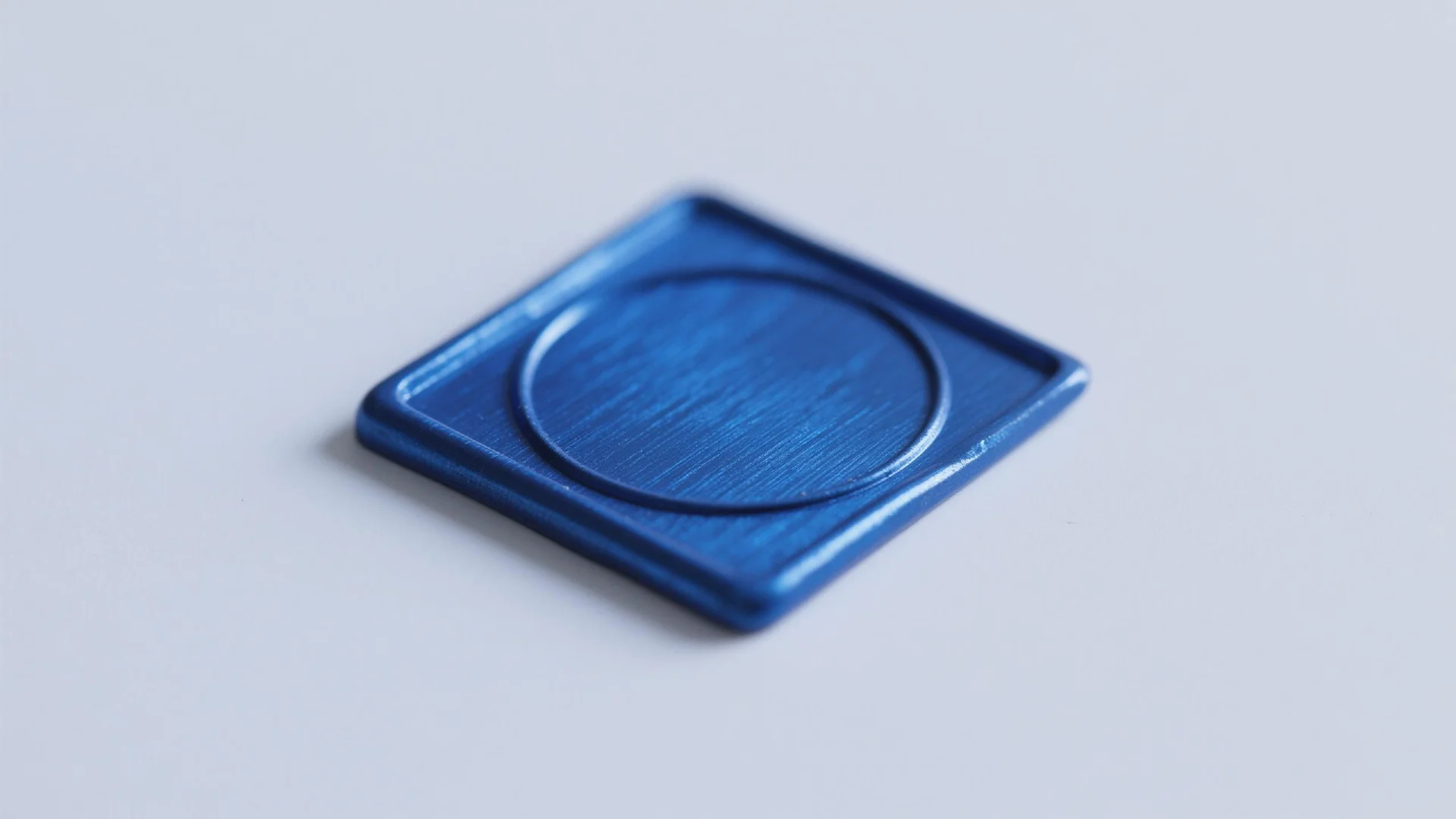

If you’re experimenting with meme coins and social tipping, self-custody can meaningfully reduce counterparty risk. A hardware wallet like OneKey helps keep private keys offline while you transact on Base via a connected app.

- Why it fits DEGEN use: Meme coins move fast, and approvals can be risky. OneKey’s secure signing, address verification, and compatibility with EVM networks (including Base) help you confirm what you’re signing and keep long-term holdings safer while using a separate “hot” account for daily activity.

- Practical setup: Store long-term DEGEN and ETH on OneKey, interact with Frames and DEXs from a smaller “spending” account, and periodically sweep profits back to cold storage.

Stay curious, stay skeptical, and size your risk. DEGEN thrives at the bleeding edge of onchain culture—exactly where good security habits matter most.