BONKSOL Token Overview: Solana’s Meme Coin with Serious Momentum

Key Takeaways

• BONKSOL refers to the BONK/SOL trading pair and its associated LP token, not a standalone coin.

• Solana's low fees and high throughput make it a prime environment for meme coin trading.

• Understanding liquidity pool mechanics is crucial for traders to manage risks like impermanent loss.

• Always verify token mint addresses to avoid scams and impersonation.

• Secure custody practices, such as using hardware wallets, are essential for long-term asset protection.

Solana’s low fees, fast block times, and thriving DEX ecosystem have turned it into the epicenter of meme coin trading. If you’ve been watching the SOL stack in 2024–2025, you’ve likely seen “BONKSOL” pop up across terminals and Telegram threads. But what exactly is BONKSOL, how does it relate to BONK, and what should traders know before jumping in?

This overview breaks down the BONKSOL naming convention, liquidity mechanics, market drivers on Solana, security best practices, and key catalysts to watch as the meme coin cycle evolves.

What Is BONKSOL?

In most Solana DEX interfaces, “BONKSOL” is shorthand for the BONK/SOL market or its associated LP token, rather than a standalone coin with its own independent mint. It typically refers to:

- The BONK–SOL trading pair, often displayed as BONK/SOL or BONK-SOL on aggregators and DEX UIs

- The LP token you receive when you deposit BONK and SOL into a pool (e.g., on Raydium or Orca), sometimes labeled “BONK-SOL LP” or informally “BONKSOL”

To avoid confusion:

- BONK is the meme coin with its own token mint on Solana. You can verify BONK’s contract and markets via CoinGecko or CoinMarketCap, which also list the official mint address and marketplaces for reference. See BONK on CoinGecko or CoinMarketCap.

- SOL is the native token of the Solana network. For protocol details, see the Solana documentation.

- “BONKSOL LP” represents a position in a BONK–SOL liquidity pool. If you hold this LP token, you are exposed to pool dynamics like fees and impermanent loss. Learn LP basics in Raydium’s liquidity docs or Orca’s liquidity guide.

Always verify whether you’re trading the base asset (BONK) or an LP token (BONK-SOL) before executing transactions.

Why Solana Drives Meme Coin Momentum

The core reasons Solana has become the center of meme coin activity include:

- High throughput and low fees, enabling retail-friendly micro-trades and rapid market formation across dozens of pairs. Technical underpinnings for accounts and SPL tokens are documented in the SPL Token standard.

- A mature DEX and aggregator stack (Raydium, Orca, Jupiter), which helps route orders and unlock liquidity depth with minimal friction. Explore routing on Jupiter.

- Ongoing performance work across the validator ecosystem and clients that aim to keep the network resilient even during speculative surges. Follow network and client updates on the Solana news page.

This infrastructure supports quick launches, heavy retail participation, and intense price discovery—conditions where meme coins tend to flourish.

BONKSOL Mechanics: Pair, LP, Fees, and Impermanent Loss

If you deposit BONK and SOL into a DEX pool, you’ll typically receive a BONK-SOL LP token in return. That LP token:

- Tracks your proportional ownership of the pool

- Accrues a share of trading fees generated in the BONK–SOL market

- Is subject to impermanent loss if the price of BONK diverges materially from SOL

Understanding LP math is essential. Many traders choose to swap BONK directly rather than provide liquidity because LP returns can be offset by price movement. If you are new to LPs, start with conceptual primers via Raydium’s docs or Orca’s docs.

If, instead, you’re targeting the base asset (BONK):

- Make sure you’re swapping the actual BONK token mint and not a similarly named fake.

- Use reputable aggregators and explorers to cross-check mint and markets. See Jupiter for routing and Solscan for on-chain token verification. Market overviews are also available via DEX Screener and Birdeye.

Market Access and On-Chain Verification

Here’s a simple process to minimize mistakes:

- Start with a trusted listing page for BONK, such as CoinGecko or CoinMarketCap. Copy the official mint address.

- Paste the mint into Solscan to verify token metadata, holders, and recent transfers.

- Use Jupiter to route your swap across Solana DEXs. Confirm that the quote references the same mint and check slippage carefully.

- If you’re providing liquidity, consult pool documentation on Raydium or Orca, and understand deposits, withdrawals, fee accrual, and IL risk.

This workflow helps distinguish BONK from BONK-SOL LP representations and reduces the chance of interacting with spoofed assets.

2025 Themes and Catalysts to Watch

- Retail liquidity depth on Solana: As more wallets and retail participants flow into SOL-based DEXs, BONK–SOL markets can sustain higher volumes and tighter spreads. Follow general ecosystem updates on the Solana news hub.

- MEV and blockspace: Improvements in Solana’s MEV tooling and validator performance matter for price execution and fair access. For Solana-specific MEV infrastructure and research, see Jito Network.

- Aggregation and smart order routing: Continued upgrades to Jupiter and DEX UIs will streamline execution for retail, which supports user experience in volatile meme markets. Explore the aggregator at Jupiter.

These factors contribute to sustained momentum across meme assets, including BONK and its BONK–SOL markets.

Risks: Volatility, Rug Pulls, and LP-specific Considerations

- Extreme volatility: Meme coins can experience sudden run-ups and drawdowns. Use tight risk controls and avoid oversized positions.

- Impersonation and fakes: Always validate the mint address via Solscan and cross-check reputable listings like CoinGecko.

- LP impermanent loss: LP tokens like BONK-SOL may underperform simply holding the stronger-moving asset during directional trends. Review mechanics via Raydium’s docs or Orca’s docs.

- Smart contract risk: Pools, farm contracts, and routing logic can contain bugs or exploits. Diversify operational risk and monitor announcements from core projects via the Solana news page.

Custody and Security: Storing BONK or BONK-SOL

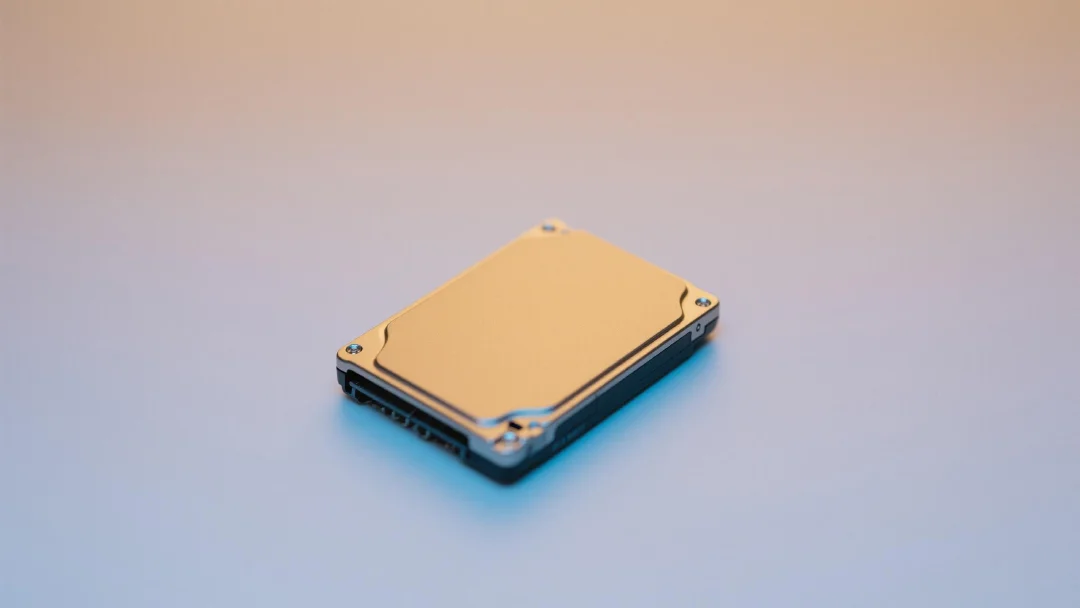

If you intend to hold BONK or BONK-SOL LP tokens beyond short-term trading, prioritize secure, self-custodial storage:

- Verify token mint and transaction details in explorers like Solscan.

- Use a hardware wallet to reduce hot-wallet exposure and mitigate phishing risk.

- Maintain strong operational hygiene: offline recovery phrases, passphrase protection, and careful approvals in DEX UIs.

For users who want durable, multi-chain self-custody with Solana support, OneKey offers open-source firmware, offline signing, and a secure element to safeguard private keys. It’s a practical way to separate long-term holdings (SOL, BONK) from day-to-day trading activity, especially in volatile meme coin markets.

Bottom Line

“BONKSOL” generally denotes the BONK–SOL market or its LP token on Solana DEXs, not a separate base asset. Before trading, confirm whether you’re swapping BONK or interacting with BONK-SOL LP positions, and validate mint addresses via explorers and reputable listings. Solana’s throughput, low fees, and aggregation tooling continue to power meme coin momentum into 2025, but disciplined risk management and secure custody—ideally with a hardware wallet like OneKey—remain essential.